Need a life-long protection? Get a Traditional Whole Life Insurance quote

Do you have good or ok-health and no serious pre-conditions? Are you looking for an insurance product to protect your loved ones and for an investment product to accumulate value? A traditional whole life insurance policy stays with you for your whole life (since it is a permanent insurance policy) as long as you pay your premiums.

We will help you get a traditional whole life insurance quote comparing the products of 20+ insurance companies. Simply complete the form below and our broker will contact you to provide a tailored traditional life insurance quote.

Get your tailored Traditional Life Insurance quote

What is Traditional Whole Life insurance?

Traditional Whole Life Insurance policy is a life insurance policy that covers you as long as you pay premiums (i.e. the whole life). Coverage limits can vary from $50,000 to $5,000,000. Traditional Whole Life Insurance has two components: insurance that pays if a policyholder dies and cash accumulation component that grows over time.

Permanent coverage: Traditional Whole Life Insurance (similarly to Traditional Universal Life Insurance) is a type of a permanent life insurance and stays in force during your whole life as long as you pay the premiums.

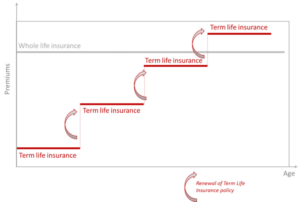

Constant premiums: As opposed to Term Life Insurance that goes up with age (e.g. if your previous Term Life Insurance policy came to the end and you need to get a new one), Traditional Whole Life Insurance premiums are the same life long. They are higher than Traditional Term Life Insurance premiums during the younger years and lower than Traditional Term Life Insurance premiums during the older years.

Combination of insurance and investment product: Traditional Whole Life Insurance is both a protection and an investment product since it accumulates cash.

Coverage limits: Coverage limits for Traditional Whole Life Insurance can vary widely: from $50,000 to as much as $5,000,000. You need to know that costs to raise a child a Canada up to the age of 18 often reach $500,000+. Do you have multiple kids? Do your math to make sure that you have enough coverage.

Ability to borrow: If you have a Traditional Whole Life Insurance or Traditional Universal Life Insurance policy, you can borrow from the accumulated cash in your policy. The more you have accumulated in your policy, the more you can borrow.

How do my payments for Traditional Whole Life Insurance policy change with time?

Your Traditional Whole Life insurance rates are level for life (see the grey line), unlike in Traditional Term Life Insurance where premiums go up every time when you renew it (see red line).

Typically, Traditional Whole Life Insurance premiums are higher than Term Life Insurance rates, because this type of insurance has both a protection and investment component.

This policy is a good choice if you are able to pay into your policy earlier in your life (e.g. due to a well-paid job) and do not want to worry about investment topics. The Traditional Whole Life Insurance policy will handle it for you.